In the vibrant city of Pune, Ravi and Priya Sharma had always dreamed of owning a home. Like many young Indian couples, they were caught between the rising cost of real estate and their aspirations of settling into a space they could call their own. The Sharmas represent a common client persona in the bustling Indian housing market—ambitious, middle-class families striving for stability and growth.

These families often face the daunting challenge of sky-high property prices. For Ravi and Priya, the primary obstacle was not just financial but emotional. They longed for a home where they could watch their children grow, celebrate festivals, and build lifelong memories. However, the prospect of a hefty down payment and the complexities of securing a loan seemed overwhelming.

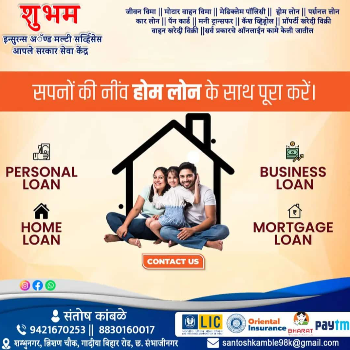

Enter the transformative power of home loans—financial solutions designed to bridge the gap between dreams and reality. The product caters to individuals like the Sharmas, offering a clear pathway to home ownership by addressing a major problem the burden of upfront costs.

Ravi, a software engineer, and Priya, a school teacher, both contribute to the household income. Yet, despite their steady earnings, saving enough for a down payment felt insurmountable. The home loan offered them a practical solution staggered payments over time, making it feasible to own a home without depleting their savings.

The emotional relief was palpable. With a home loan, Ravi and Priya could focus on creating a nurturing environment for their children without the constant worry of financial strain. It provided them with more than just a house; it gave them peace of mind and the freedom to plan for the future.

Consider the case of Arjun and Meera, another couple who benefited from a home loan. Living in Bangalore, they faced a similar predicament—how to buy a home in a city where property prices seemed perpetually out of reach. Through a well-structured home loan, they managed to secure a spacious apartment in a locality that was ideal for their family’s needs.

The success of such families highlights the importance of home loans in today's market. These financial tools are tailored to meet the needs of middle-class Indians, offering flexible repayment options and competitive interest rates. They not only alleviate the immediate financial burden but also empower families to invest in their future.

Moreover, the process of obtaining a home loan has become increasingly streamlined. With digital platforms, applicants can now complete much of the process online, from application to approval, making it convenient for busy professionals like Ravi and Priya.

In addition to practicality, home loans provide an emotional anchor. They transform the concept of home ownership from a distant dream to an achievable goal. For many, it’s the key to unlocking a lifestyle that includes stability, security, and a sense of accomplishment.

In conclusion, home loans are much more than financial products; they are enablers of dreams. For families like the Sharmas and countless others across India, they represent hope and opportunity. By addressing both the practical and emotional aspects of buying a home, these loans pave the way for a brighter, more secure future.

As you consider your own journey towards home ownership, remember the stories of Ravi, Priya, Arjun, and Meera. Explore the possibilities a home loan can offer. Your dream home might be closer than you think, waiting to be unlocked with the right financial solution.

Embrace the journey and take the first step towards making your dream home a reality. After all, as the Sharmas discovered, a home is not just where you live; it’s where you build your life.

Visit Vyaparify Site:

https://id.vyaparify.com/shubham-inssurance-and-multi-services